The world of electric vehicles (EVs) has rapidly evolved over the past few years, marked by fierce competition among technology giants aiming to dominate the market. At the heart of this evolution lies the imperative of battery technology, which is crucial for enhancing performance, range, and cost efficiency. Tesla, a leader in the EV sector, has made bold claims about their innovative 4680 cylindrical battery cells. However, Robin Zeng, the founder and chairman of Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV battery manufacturer, is openly skeptical about the success of Tesla’s ambitious battery strategy.

Zeng’s Critique of Tesla’s Approach

During a notable encounter in April, Zeng and Tesla CEO Elon Musk engaged in a heated debate about battery technology. According to Zeng, this discussion highlighted Musk’s limitations in battery knowledge, stating that Musk was left “silent” during their exchanges. In stark contrast, Zeng prides himself on his expertise within the battery domain, noting that CATL’s lithium iron phosphate (LFP) batteries, while less energy-dense than Tesla’s 4680 cells, are widely successful across various platforms.

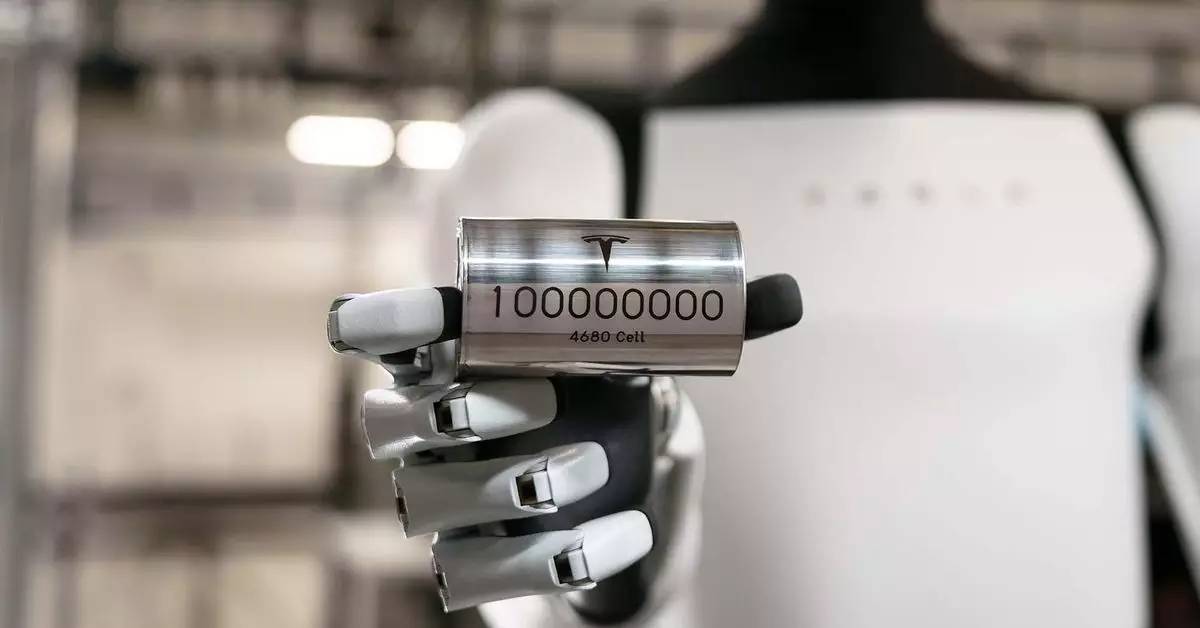

Tesla’s 4680 cells are intended to dramatically improve energy capacity, boasting a claimed five-fold increase in efficiency. Yet, the practicality of this innovation remains under scrutiny. As per reports, Musk has set aggressive deadlines for addressing cost and engineering challenges, raising questions about the feasibility of these targets. The pressure of rapid innovation may lead to overpromising, a point Zeng emphasized, referencing Musk’s tendency to miscalculate timeline expectations, especially in relation to projects like Full Self-Driving technology.

Market Dynamics and Strategic Imperatives

While Tesla’s advancements attract considerable attention, Zeng reminds stakeholders of the essential realities of the EV market. CATL’s batteries power a variety of vehicles, including those produced by Ford and other industry players, underlining the diverse applications and competitive landscape of battery technology. Currently, CATL’s dominance in the LFP market serves as a strategic advantage, especially given the increasing demand for EVs that are both cost-effective and reliable.

Zeng’s critique also alludes to the inherent tension in the tech world, particularly when cutting-edge innovation meets market delivery timelines. The rapid pace of technological advancement often invites skepticism from competitors and industry veterans alike, who may question whether a company can realistically meet its aspirations. For Zeng, the core issue is not merely technical prowess but also a sustainable approach to innovation.

As the tensions surrounding Tesla’s battery innovations unfold, stakeholders in the EV industry would do well to observe the dynamics at play. The outcome of Tesla’s 4680 cells could influence not only the company’s future but also shape the broader landscape of electric mobility. Zeng’s insights provide a valuable lens through which to view the importance of realistic projections and the value of expertise in a rapidly changing market. The evolving narrative will surely be one of caution, innovation, and the ongoing quest for optimal solutions in the realm of electric vehicle technology.

Leave a Reply