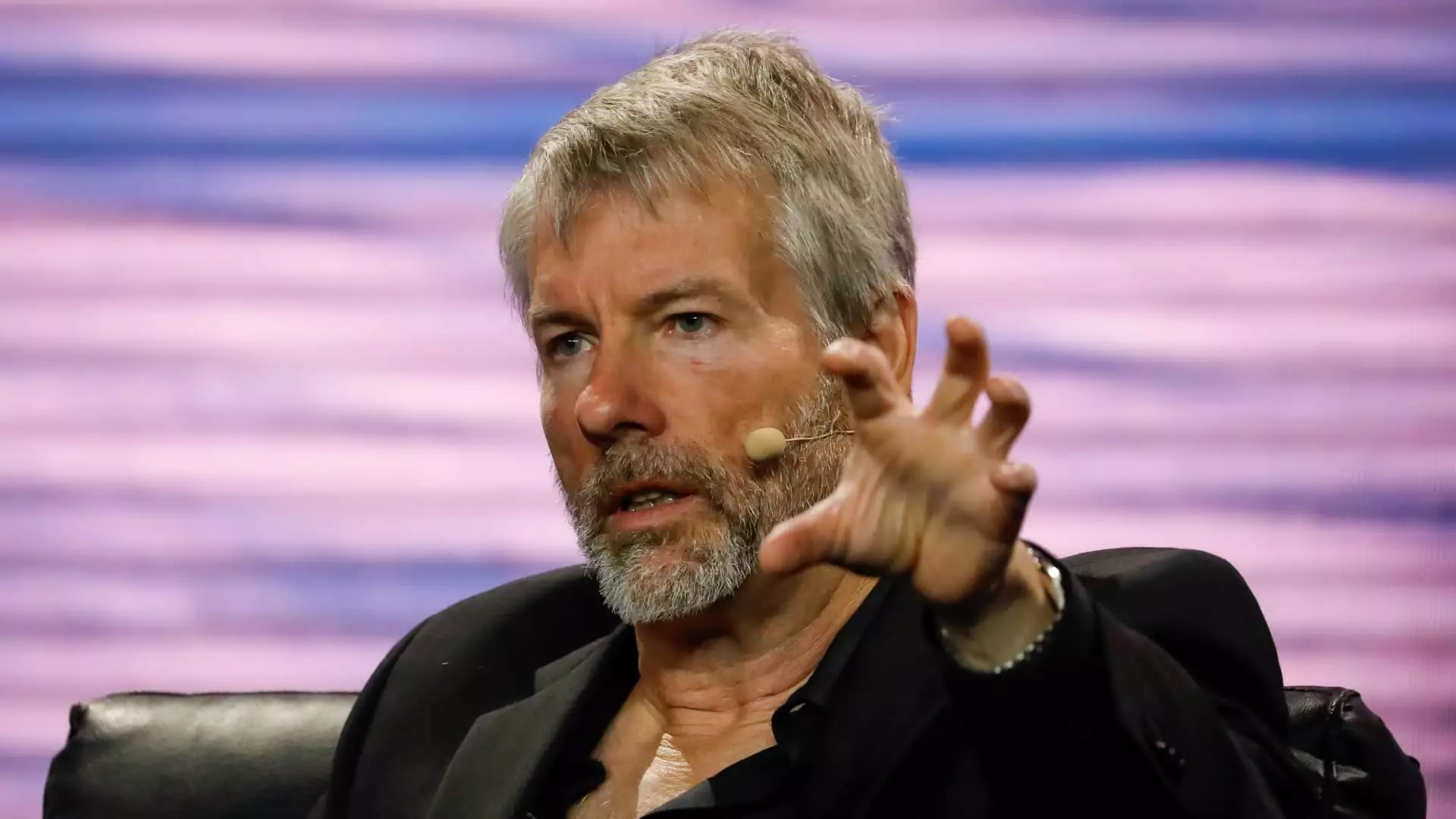

Michael Saylor has been causing quite a stir in the financial world with his recent bitcoin investments. Every time he mentions the word “bitcoin,” MicroStrategy shares experience a surge. The latest announcement on social media revealed that the company had acquired an additional 12,000 bitcoins for nearly $822 million, using funds from convertible notes and excess cash. This purchase has brought MicroStrategy’s total bitcoin holdings to 205,000, valued at over $15 billion. As a result, the cryptocurrency has been reaching new all-time highs, with bitcoin rising by 2.7% to over $73,400.

Despite being a software development company, MicroStrategy’s stock price appears to be more closely correlated with bitcoin performance than its actual business operations. Following the recent bitcoin purchase, MicroStrategy’s stock price climbed by 11% in a single day, building on earlier gains of 7.4%, 4.1%, and 9.7%. Since the company’s debt sale in March, the stock has surged by 68%, adding to a staggering 180% increase this year, after a monumental 346% surge in 2023. This growth is exceptional considering the association with bitcoin rather than traditional business metrics.

Market analysts have noted MicroStrategy’s unique approach to funding its bitcoin investments through convertible notes. This recent offering of 0.625% convertible notes due in 2030, generating approximately $782 million in net proceeds, stands out for its structure and low coupon rate. While previous bitcoin acquisitions were financed through equity, the company opted for a different strategy this time, leveraging its full capital structure through the issuance of convertible notes. This approach highlights MicroStrategy’s commitment to expanding its bitcoin holdings.

One key observation from recent market analysis is the substantial increase in MicroStrategy’s equity value premium over its bitcoin reserves. As of the latest data, the equity value premium stands at a significant 99%, indicating the market’s faith in the company’s bitcoin investment strategy. Despite its origins as an enterprise software and cloud services provider, MicroStrategy’s stock value is now heavily influenced by its bitcoin holdings, emphasizing the impact of alternative asset investments on shareholder value.

Company Evolution

MicroStrategy’s transformation from a software company to a dominant player in the cryptocurrency market has been remarkable. The decision to invest in bitcoin back in 2020, with an initial commitment of $250 million, has propelled the company’s market capitalization to $30 billion. This strategic shift has redefined MicroStrategy’s identity in the market and positioned it as a pioneering force in alternative asset investments. The rapid appreciation of its stock value in relation to bitcoin holdings underscores the success of this strategic pivot.

Michael Saylor’s bold foray into bitcoin investments has not only reshaped MicroStrategy’s financial performance but also redefined its market standing. The company’s aggressive approach to acquiring bitcoins and leveraging convertible notes has yielded impressive results, propelling both its stock price and overall market capitalization to new heights. As institutional interest in bitcoin grows and market dynamics continue to evolve, MicroStrategy’s position as a key player in the cryptocurrency space is set to strengthen further.

Leave a Reply